idaho education tax credit 2021

Department of Labor Tax. Idaho Department of Commerce Business Tax Incentives.

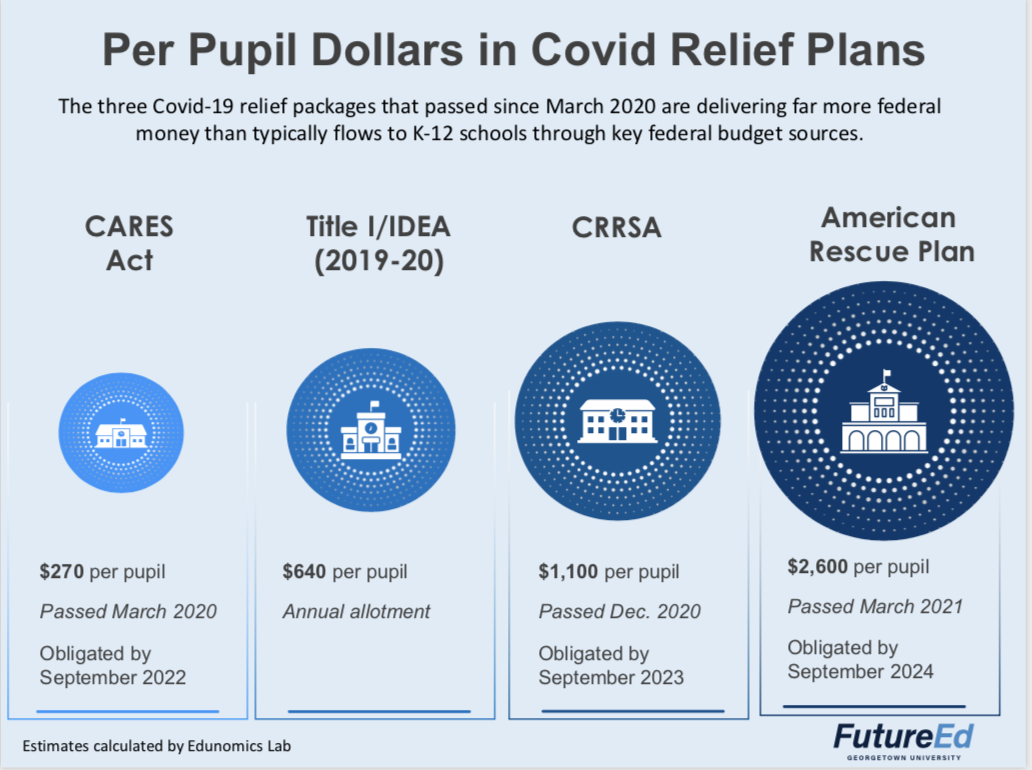

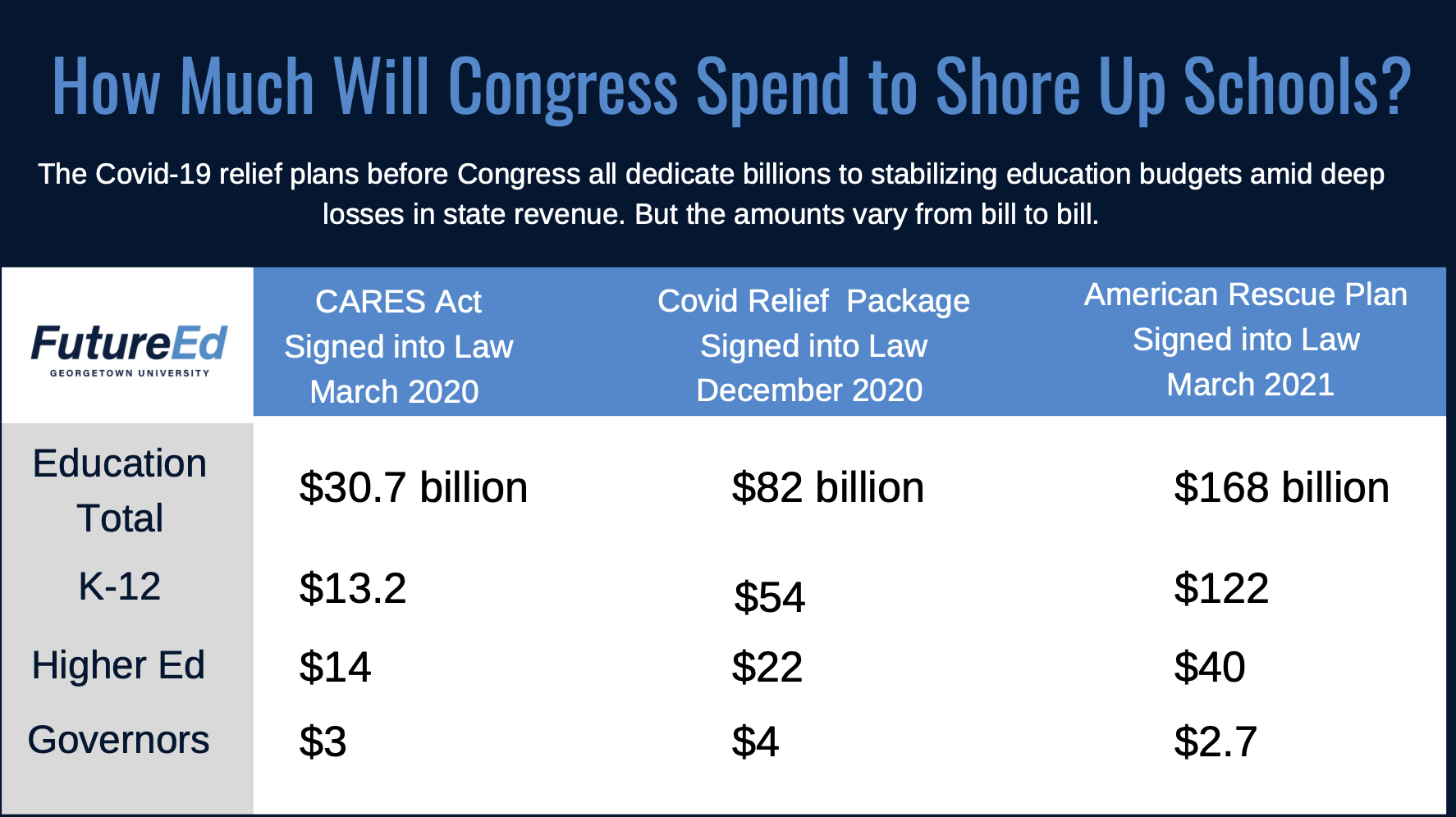

What Congressional Funding Means For K 12 Schools Futureed

If you itemize your taxes a donation to North Star allows income tax deductions on your state and federal returns plus a 50 Idaho income tax credit.

. Object Moved This document may be found here. Idaho State Tax Commission Employer Tax Credits. The state tax credit is up to 50 or 1000 of your donation for married couples 500 for individuals.

Internal Revenue Service Business Tax Credits. Returning Heroes and Wounded Warrior tax credits. Educational Contribution Credit - limited to the smallest of one-half donated.

Withdrawals are limited to tuition payments up to 10000 per year per student. Fact Book 2021. For example a couple filing a joint return can claim a credit up to 1000 on a contribution of 2000 or more.

Heres how it will work. The two core priorities for Idaho throughout this school year are addressing the academic impact of lost instructional time and the challenges to student staff and community wellbeing created by COVID-19. Contact your local college or university to see if this program is offered in your area.

Dual credit sometimes called concurrent enrollment is course work in which a secondary student is enrolled in a college level course which is also counted as a secondary course for high school graduation purposes. Higher Education in Idaho Booklet. Grocery Credit - 100 per exemption An additional 20 may be claimed if you are over age 65 and a resident of the state.

Visit Idahos Legislature website for More Information Idaho Statute 63-3029A. Brad Littles office announced Friday. Idahos K-12 education budget tops 2 billion as committee approves By Kevin Richert Idaho Education News March 12 2021 901 PM.

The Idaho State Board of Education makes policy for K-20 public education in Idaho to create opportunity for lifelong attainment of high-quality education research and innovation. Make a gift today and earn your Idaho Tax Credit this year while creating a significant impact at Bishop Kelly. Fuels Taxes and Fees.

Americans with Disabilities Act ADA US. This credit is available regardless of whether or not you itemize deductions. Idahos surplus is the highest its ever been 19 billion and counting which represents 40-percent of the General Fund.

IT Help Desk. 50 of tax on line 42 of form 43. Idaho Department of Labor Work Opportunity Tax Credit.

Idaho individuals may take up to 50 of a gift of. The college entrance exam requirement has been waived for students graduating during the 2021-2022 school year including summer 2022 term. December 29 2021 By Cascade Library Staff.

The Economic Value of Idaho Public Colleges and Universities Executive Summary. As an Idaho tax payer your donations to the University of Idaho and the College of Law may be eligible for a 50 percent education tax credit. Qualified withdrawals from a 529 account can be used toward 1.

January 19 2021 Agenda Minutes February 16 2021 Agenda Minutes March 16 2021 Agenda. 20 tax credit for Idaho employers of up to 500 per employee per year for contributions made to the employees IDeal account 4. Take a minimum of 46 high school credits which include 29.

Idaho State Tax Savings 7 19 37 74 Idaho Tax Credit 50 125 250 500 Total Savings for the Year 82 207 412 824 Your actual cost of the gift 18 43 88 176 Idaho Individuals may take up to 50 of a gift up to 1000 a tax credit of up to 500. 2021 Meeting Dates Agendas Minutes. Going to school can help you when tax season comes around.

Idaho Education Tax Credit. January 26 2022 By Cascade Library Staff. E911 - Prepaid Wireless Fee.

Governor Little proposes paying off state building debt clearing out one-third of backlogged repairs in infrastructure and bringing rainy-day funds to a. The State of Idaho provides an income tax credit to taxpayers who give to schools or educational organizations and museums like Idaho Botanical Garden through the Idaho Education Tax Credit. Electricty Kilowatt Hour Tax.

It doesnt have to cost a lot to make a big difference at Bishop Kelly. Income tax credit for charitable contributions Limitation. State requirements include that all students.

If their tax liability was 5000 the credit reduces it to 4000. The state provides a tax. Idaho Education Tax Credit Home.

For those who do itemize a donation to the U of I allows income tax deductions on both your state and federal returns. The property must have a useful life of three years or more and be property that youre allowed to depreciate or amortize. Investment Tax Credit 2021 Qualifying Depreciable Property Idaho generally follows the definition of qualified property found in the Internal Revenue Code IRC sections 46 and 48 as in effect before 1986.

Updated at 122 pm August 1 2021 Share This BOISE KIVI Idaho residents could see tax relief money as early as next week Gov. And we continue our focus on improving literacy for our youngest students and preparing older students for careers. Idaho has a unique tax credit opportunity specifically for contributions to schools.

You make a gift to Idaho Botanical Garden a museum. At the election of the taxpayer there shall be allowed subject to the applicable limitations provided herein as a credit against the income tax imposed by chapter 30 title 63 Idaho Code an amount equal to fifty percent 50 of the aggregate amount of charitable. Listed below are the credits that are available to you on your Idaho return.

Gifts to North Star Charter may qualify for a 50 tax credit a reduction in the actual tax you owe. Idaho Education Tax Credit. Certain room and board costs.

Current Book Review 2021 Archives.

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com

No Fresh Start In 2021 Will States Let Debt Collectors Push Families Into Poverty As Pandemic Protections Expire Web Version National Consumer Law Center

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out Cbs News

State Income Tax Rates Highest Lowest 2021 Changes

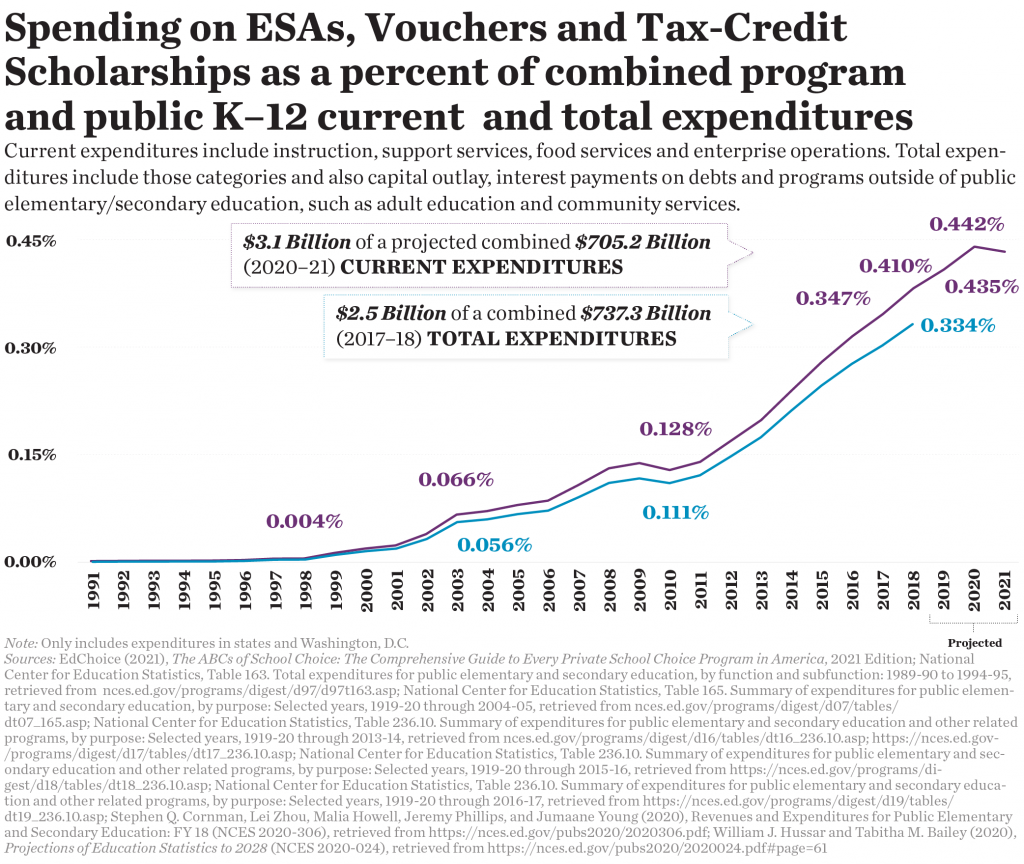

2021 Edchoice Share Where Are America S Students Getting Their Education Edchoice

Cash Rich States Are Slashing Taxes Amid Revenue Windfalls

What Congressional Funding Means For K 12 Schools Futureed

Idaho Receiving 5 6 Billion Through Arpa Now The Hard Work Begins Idaho Reports

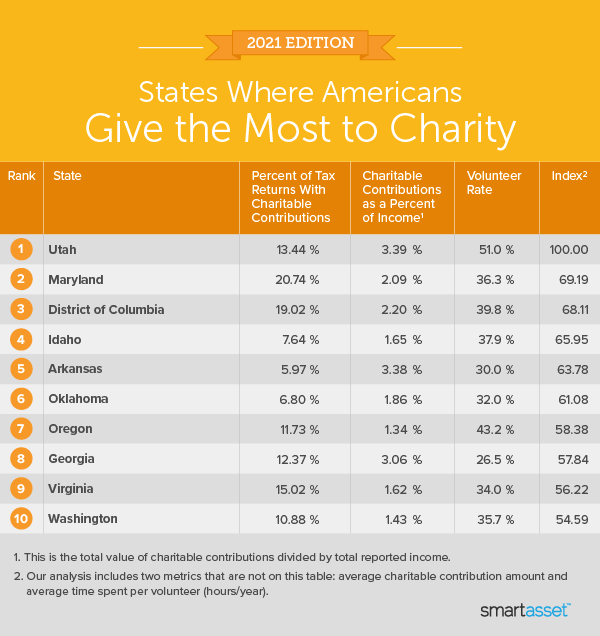

Where Do Americans Give The Most To Charity 2021 Edition Smartasset

Sample Of A Research Proposal Introduction In 2021 Persuasive Essay Topics Essay Topics Essay

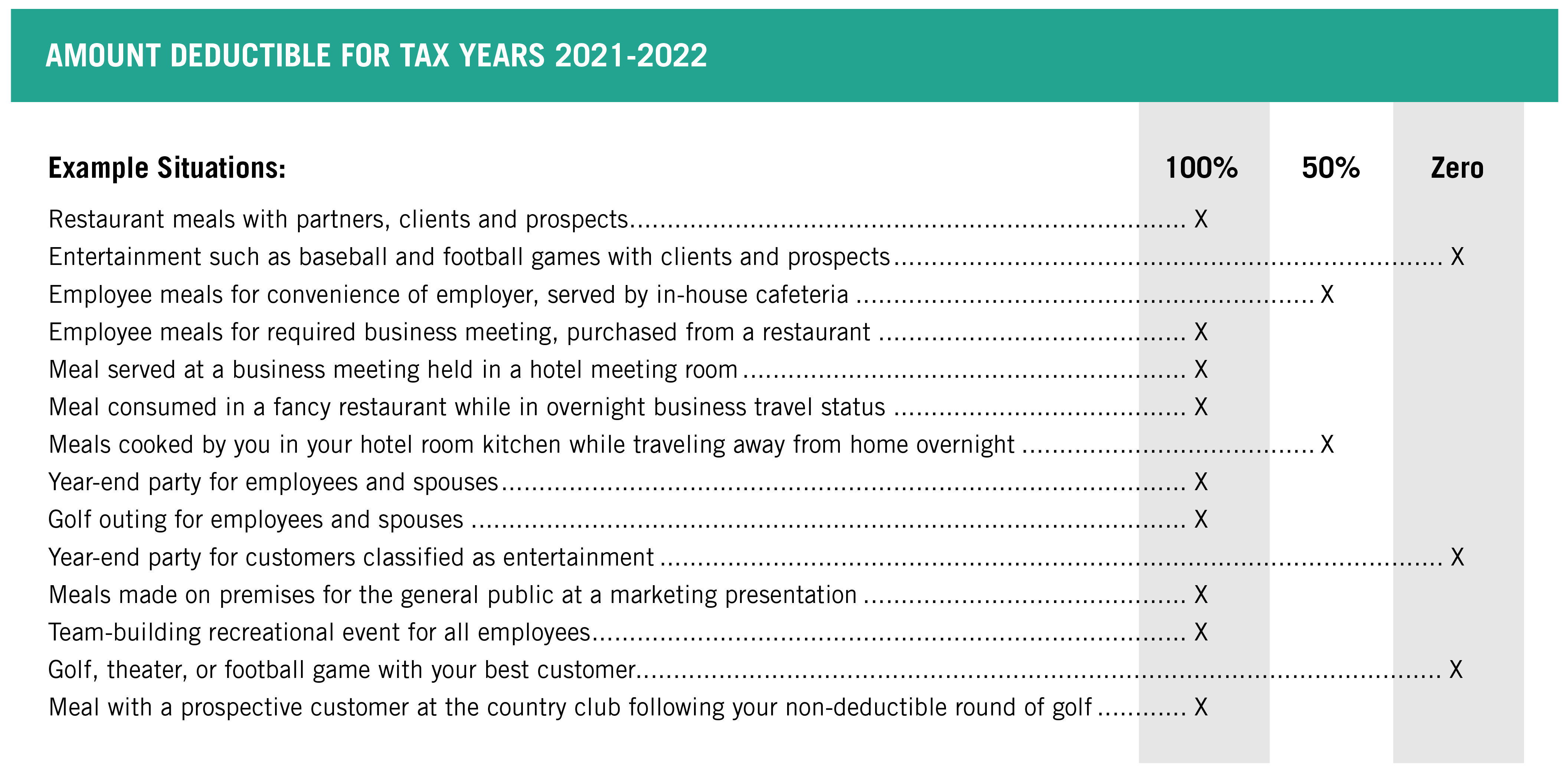

Meals Entertainment Deductions For 2021 2022

How To Build A Media List For Publicity Submissions In 2021 Online Business Marketing Online Marketing Strategies Public Relations Strategy

Ability To Respond Horizonpwr Solar Solar Energy Facts Fastest Growing Industries Solar Panel Installation

Idaho State Senator Floats Plan That Would Eliminate School Supplemental Levies Idaho Capital Sun

Who Qualifies For The 500 Dependent Credit And Who Doesn T Get The Child Tax Credit As Usa

Team Motivation Horizonpwr Team Motivation Solar Energy Facts Motivation

Ap Macroeconomics Unit 1 Exam Review Jeopardy Template Exam Review Macroeconomics Jeopardy Template